How to Calculate Portfolio Risk From Scratch (Examples Included) - Fervent | Finance Courses, Investing Courses

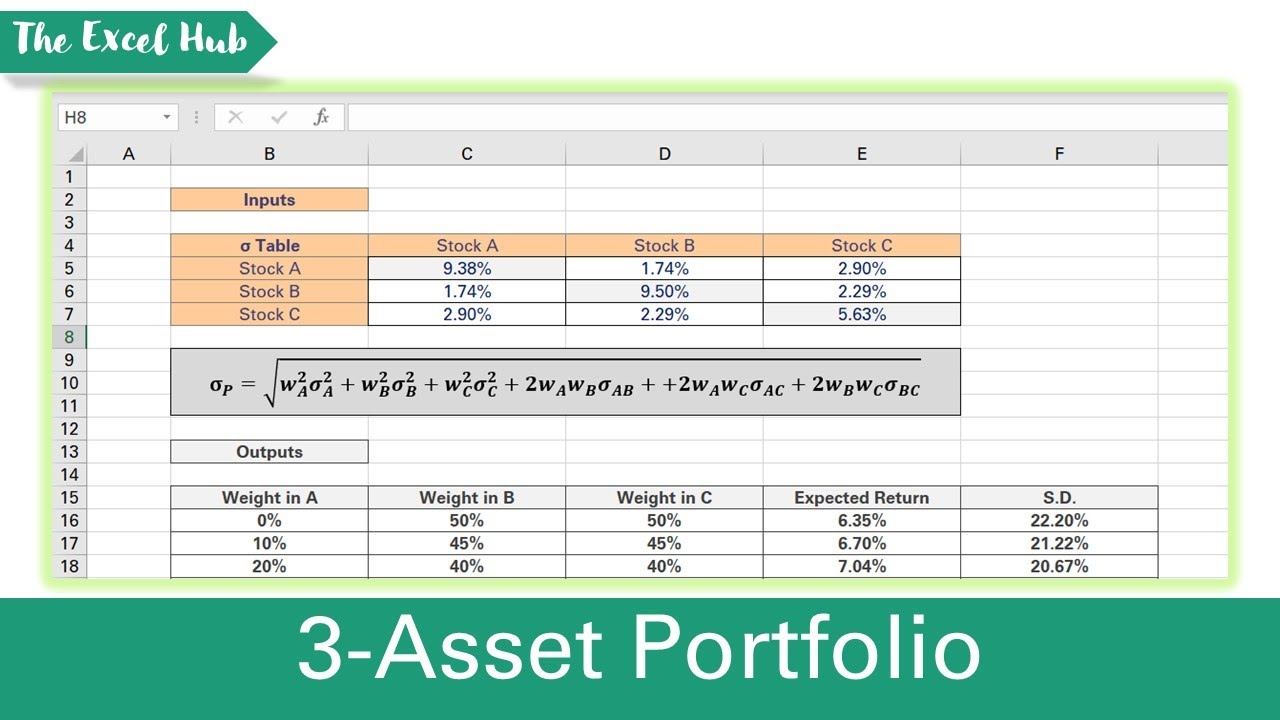

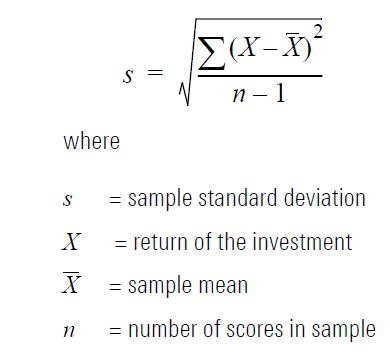

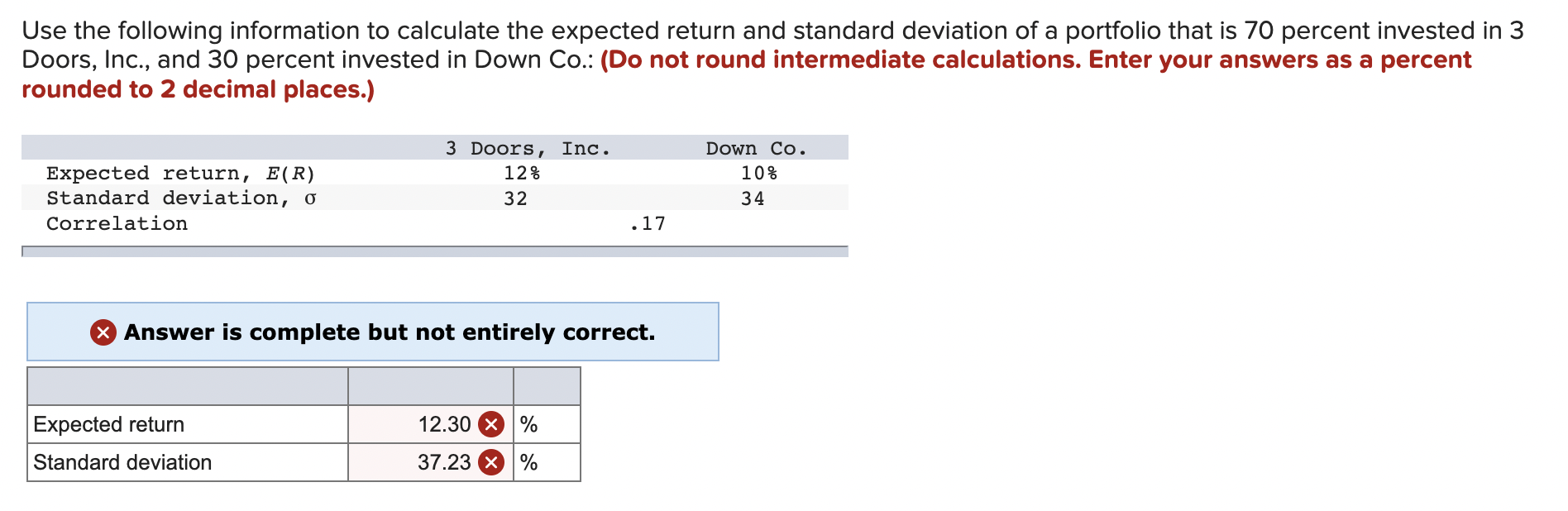

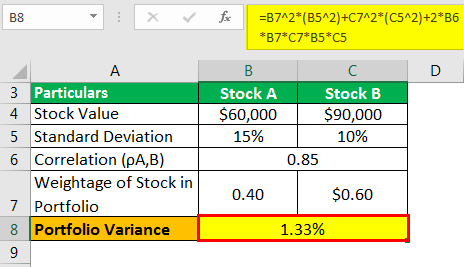

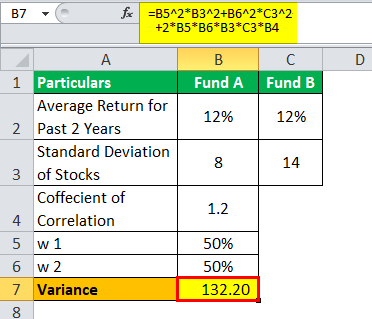

Calculating Portfolio Return and Standard Deviation This figure shows a... | Download Scientific Diagram

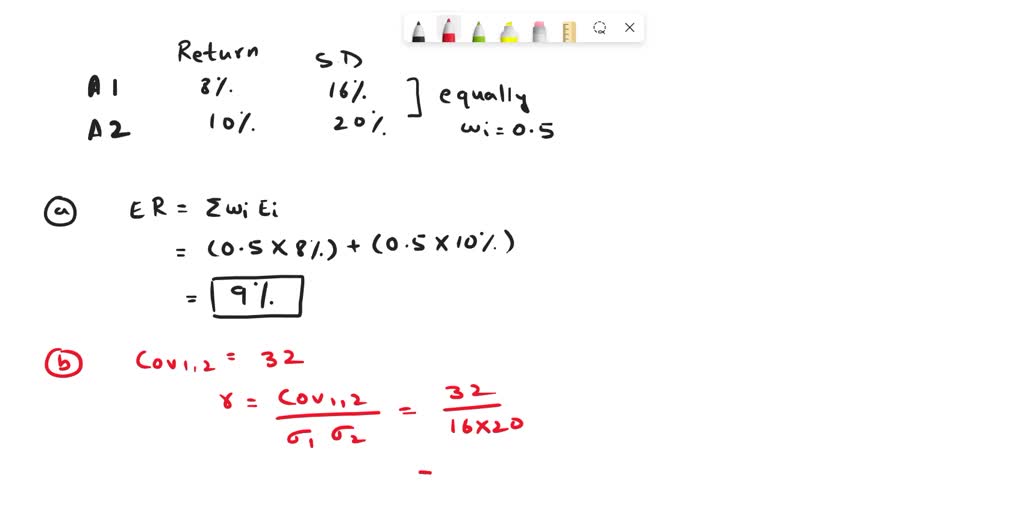

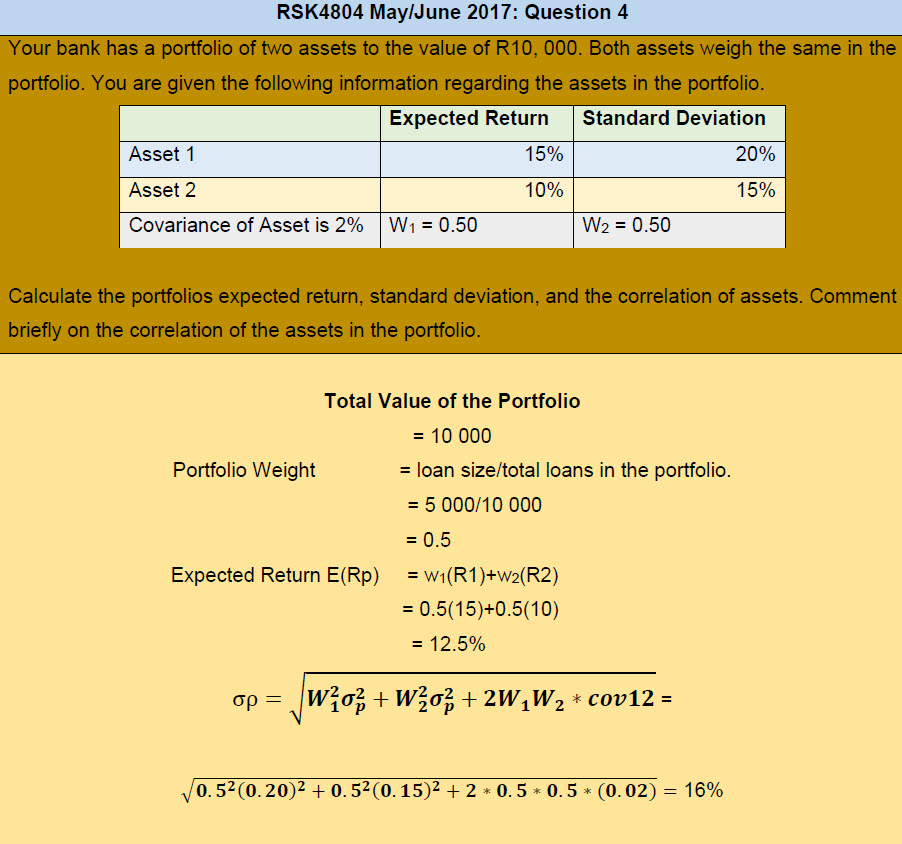

SOLVED: A portfolio consists of two assets, the expected returns and standard deviations of returns of which are listed in the table below; Asset 1 Asset 2 Expected Return 8% 10% Standard

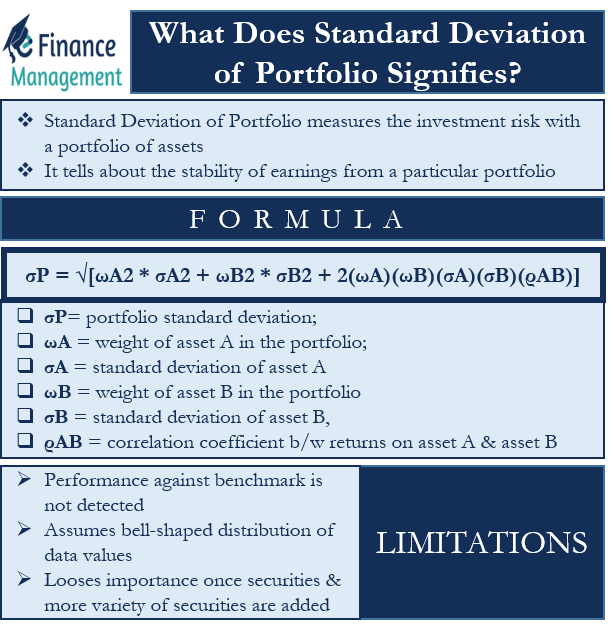

:max_bytes(150000):strip_icc()/Standard-Deviation-ADD-SOURCE-e838b9dcfb89406e836ccad58278f4cd.jpg)

:max_bytes(150000):strip_icc()/Standard_deviation.svg-1743ea3e58a64d439332723f49dbc8d2.png)